Distilling industry pouring millions into metro economy

LOUISVILLE, Ky. (Sept. 20, 2013) – Kentucky’s bourbon boom has turned into a bourbon boon for Louisville.

Jefferson County is one of the biggest winners in the bourbon renaissance, with the signature industry providing 4,200 jobs, $263 million in payroll, $32 million in tax revenue and $50 million in capital projects in 2012, Mayor Greg Fischer said Friday.

Those were the results of a first-ever study by the University of Louisville on the distilling industry’s tremendous economic impact in the River City. Fischer and executives from U of L and the bourbon industry released the study today during an event at Brown-Forman Corp.

Those were the results of a first-ever study by the University of Louisville on the distilling industry’s tremendous economic impact in the River City. Fischer and executives from U of L and the bourbon industry released the study today during an event at Brown-Forman Corp.

“Bourbon has been part of Louisville’s economy since George Rogers Clark and his band of pioneers planted corn here in 1778,” Fischer said. “The fact that it’s a homegrown industry always has been special. But the growth we’ve seen the last few years is extraordinary.

“Today, if you’re talking about investment, jobs and success in Louisville, the first word that comes to mind is bourbon. It is a vital part of our culture and our future, from the culinary arts to tourism, new craft distilleries and more. We couldn’t be happier to toast these achievements.”

The study was commissioned by the Kentucky Distillers’ Association, a non-profit trade group founded in Louisville in 1880. Rick Robinson, Chairman of the KDA’s Board of Directors, said the study proves that the bourbon momentum isn’t slowing down.

“The growth in Louisville over the last five years is incredible,” said Robinson, plant manager at Wild Turkey Distillery in Lawrenceburg. “But what’s happening over the next few years is truly impressive, especially downtown, with new distilleries and tourism investments.”

Major findings include:

♦ Bourbon generates 4,200 jobs with $263 million payroll every year in Louisville, which is nearly 40 percent of all the state’s distilling, warehouse, bottling and office jobs.

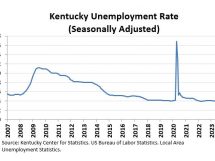

♦ Distilling industry employment has increased 10 percent in the last five years in Jefferson County. This helped Louisville weather the economic crisis as other local manufacturers lost 10 percent of their jobs.

♦ Louisville distilling generates $31.6 million in local and state tax revenue every year, including property, barrel, payroll, sales and corporate income taxes. Louisville receives about $8.6 million of this revenue, with local governments ($4.7 million) and school districts ($3.9 million) the biggest recipients.

♦ Tax payments on aging bourbon barrels have increased 128 percent in the past five years alone. The barrel tax alone accounts for $2.4 million in revenue each year, which is two-thirds of all property tax revenue in 2012.

♦ Increased worldwide demand for bourbon has produced an amber wave of capital investments in Louisville. More than $50 million in projects are underway, including many to revitalize the “Whiskey Row” area.

Bourbon tourism also is on the rise. Heaven Hill’s new Evan Williams Bourbon Experience will be the eighth official Kentucky Bourbon Trail stop – and the first in Louisville – when it opens later this year downtown. Jefferson County could realize more than $2.5 million a year in spending from bourbon tourism.

Distillers account for more than $10 million in corporate and philanthropic giving, plus thousands of hours of employee time donated to the arts, culture, education, parks, environmental, health and emergency relief causes.

Craig J. Richard, president and CEO of Greater Louisville, Inc., is taking a front row seat in the bourbon revolution. As one of GLI’s priority industry sectors, his economic development team is focused on attracting and assisting distillery operations seeking to start-up or expand in the Louisville area.

“Bourbon is an important and growing economic development sector that represents a winning combination for the region,” he said. “It helps create jobs, it draws visitors and the ‘cool factor’ helps attract and retain talented young professionals.

“However, changes to Kentucky’s tax code are needed if we are going to be successful in increasing investment and protecting our state’s signature industry from global competition.”

Richard said relief is needed for the ad valorem “barrel tax” that’s assessed each year on aging barrels in Kentucky warehouses. It’s the only such tax in the world and is not assessed on any other alcohol beverage such as beer, vodka, wine, Scotch – even Tennessee whiskey.

The ad valorem tax is one of seven taxes levied on every bottle of spirits in Kentucky, with 60 percent of every bottle going to taxes, said KDA President Eric Gregory. Tennessee – second only to Kentucky in whiskey production – taxes spirits at two-thirds the rate as Kentucky.

New craft distilleries are bypassing Louisville – and the commonwealth – because of the barrel tax, Gregory said.

“This is a Kentucky-only tax that discriminates against our historic Bourbon industry and restricts further growth right here at home,” he said.

The KDA will once again lead a legislative effort to seek relief from the barrel tax and called on lawmakers to act.

“With other states actively competing for distilleries, we need every tool available to keep Kentucky the one, true and authentic home for bourbon,” Gregory said.

To commemorate the inaugural study, the KDA and industry executives presented Fischer with a barrel head signed by master distillers from KDA member companies and engraved with, “Bourbon – Pouring Millions into Louisville’s Economy Since 1778.”

Fischer presented a proclamation honoring bourbon as a vital part of Louisville’s culture and economy, which reads:

“It represents jobs for our citizens, hospitality to our visitors, and provides a sense of place and character to our entire community. Our glass may hold an old-fashioned, a mint julep or a whiskey sour, but our hearts hold Kentucky bourbon.”

Robinson, the KDA Chairman, said the early Louisville pioneers probably never dreamed that bourbon would one day become a global industry with iconic brands that are hailed for their tradition and craftsmanship.

“The spirit of our industry is strong, and we’re fortunate to have such great community partners as Louisville and visionary leaders like Mayor Fischer who will continue to drive the bourbon momentum,” Robinson said.

“We are stronger when we work together, and I’m certain that the best is yet to come,” he said.

Distilling impact in Louisville

JOBS: Bourbon generates 4,200 jobs with $263 million payroll every year in Louisville

• Louisville hosts nearly 40 percent of the state’s distilling, warehouse, bottling and office jobs

• Distilling industry employment has increased 10 percent in the last five years in Jefferson County. This helped Louisville weather the economic crisis as other manufacturers lost 10 percent of their jobs.

• Seven companies have distilleries, headquarters or resources in Louisville, including Brown-Forman Corp., Beam, Inc., Heaven Hill Distilleries, Inc., Diageo Americas Supply, Maker’s Mark Distillery, Michter’s Distillery and Sazerac Co.

• Home to the only educational distilling company in the United States – the Distilled Spirits Epicenter, which is training the next generation of distillers from around the world

• New craft distilleries have announced plans to locate in Louisville, bringing more jobs and investment –Louisville Distilling Co. (Angel’s Envy) and Kentucky Peerless Distilling Co.

• Location of support companies vital to distilling’s success – Vendome Copper and Brass Works, Inc., Brown-Forman Cooperage and Kelvin Cooperage

REVENUE: Louisville spirits production, barrel taxes pouring millions into the local & state economy

• Louisville distilling generates $31.6 million in tax revenue every year, including property, barrel, payroll, sales and corporate income taxes

• Louisville receives about $8.6 million in tax revenue, with local governments ($4.7 million) and school districts ($3.9 million) the biggest recipients

• Tax payments on aging bourbon barrels have increased 128 percent in the last five years alone

• The barrel tax alone accounts for $2.4 million each year, which is two-thirds of all property tax revenue in 2012; the tax assessed value of barrels in Jefferson County was $269 million in 2012

• Kentucky is the only place in the world that levies a tax on aging barrels, which discriminates against our homegrown bourbon industry, puts our distilleries at a competitive disadvantage in the global marketplace and restricts further growth in the bluegrass

INVESTMENT: More than $50 million in capital projects, $10 million in philanthropic giving

• Increased worldwide demand for bourbon – and growth of the Kentucky Bourbon Trail tourism experience – has produced an amber wave of capital investments in Louisville

• More than $50 million in capital projects are underway or recently completed in Jefferson County, including many to revitalize the “Whiskey Row” district

• $10 million in corporate and philanthropic giving, plus thousands of hours of employee time to the arts, culture, education, parks, environmental, health and emergency relief causes

• Heaven Hill is investing $10 million to create the “Evan Williams Bourbon Experience” downtown, which will be the eighth Kentucky Bourbon Trail stop when it opens this fall

• Beam, Inc., Michter’s, Angel’s Envy and Peerless are developing new distilleries, tourism centers and corporate headquarters

• Jefferson County could realize more than $2.5 million a year in spending from bourbon tourism

Add Comment