FRANKFORT, Ky. — Kentucky teachers’ retirement investments posted record gains for the recently concluded fiscal year – 29.94% for the Retirement Annuity Trust and 31.53% for the Health Insurance Trust.

Returns for the Teachers’ Retirement System of the State of Kentucky (TRS) annuity trust over the last 30 years are 8.59% compounded, which is in line with the 7.5% long-term assumed rate of return. TRS staff presented the pension system’s investment results for the year ended June 30 to the Investment Committee at its Aug. 26 meeting. The net return after fees and expenses is 29.59%.

Returns for the Teachers’ Retirement System of the State of Kentucky (TRS) annuity trust over the last 30 years are 8.59% compounded, which is in line with the 7.5% long-term assumed rate of return. TRS staff presented the pension system’s investment results for the year ended June 30 to the Investment Committee at its Aug. 26 meeting. The net return after fees and expenses is 29.59%.

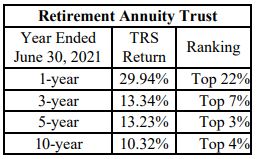

Along with the top quarter performance for the most recent year, TRS’s annuity investments were in the top 4% for the 10-year period. The returns were in the top 3% for the five-year period and in the top 7% for the three-year period. All rankings are according to Aon Investments USA’s analysis of large domestic pension plans with more than $1 billion in assets.

During the year, TRS benefitted from another year of full funding from the state budget. The fiscal year return for the trust used to pay retiree monthly annuities beat the prior record of 21.6% in 2011.

“In relation to our returns, there’s not even a close second,” TRS Executive Secretary Gary Harbin said. “It’s just a phenomenal year in the markets, and our portfolio was positioned to take advantage of that. TRS’s disciplined approach established by the Board of Trustees and implemented by TRS’s investment team has shown to be beneficial in all markets. Since the great recession, TRS has earned $20.4 billion from investments compared to the average pension plan’s $15 billion, an outperformance of about $5.4 billion to the benefit of Kentucky’s taxpayers, including teachers.”

The net return for the Retirement Annuity Trust was 29.59%, while the net return for the health trust was 31.13%.

Click here for more Kentucky business news.