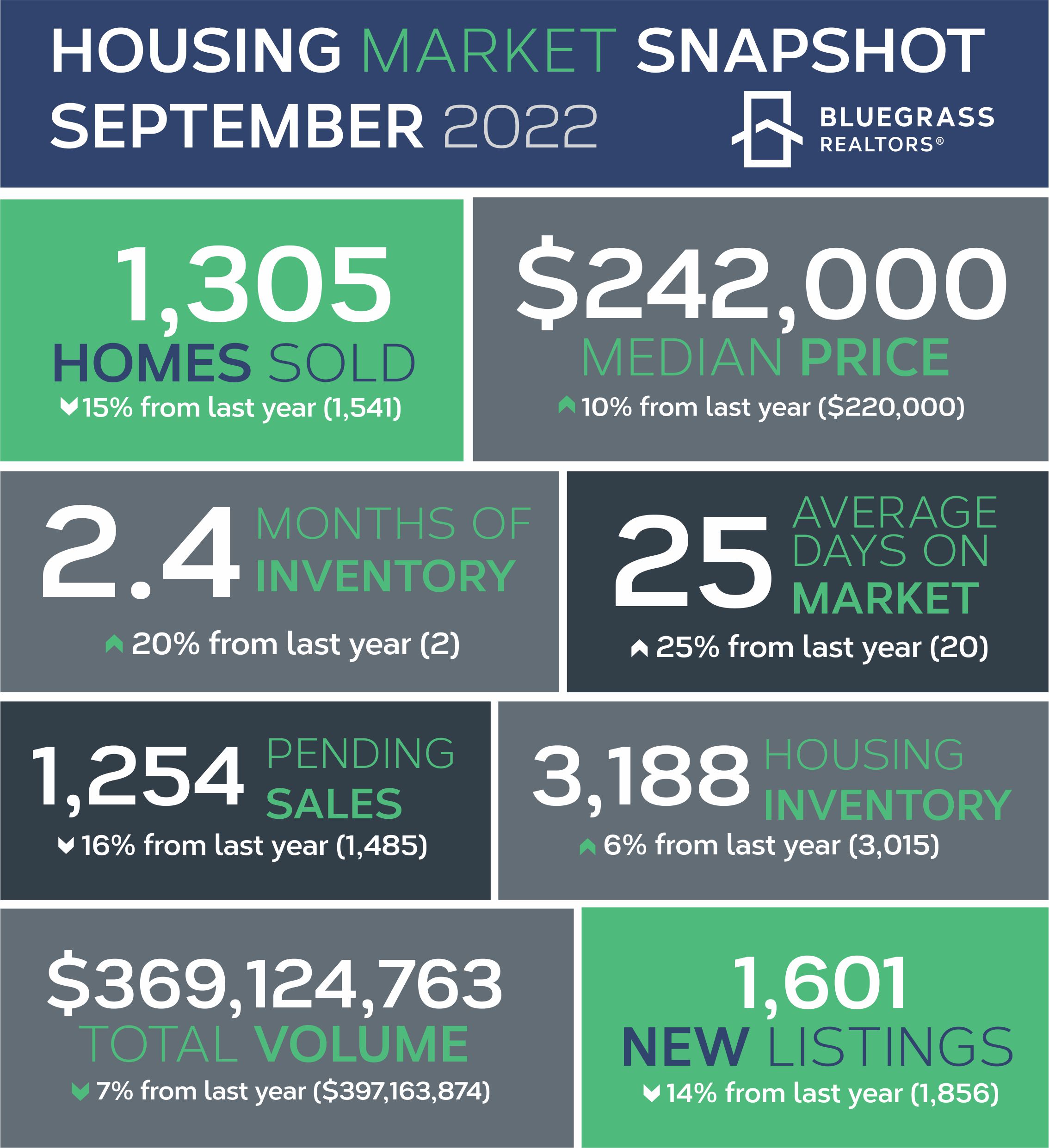

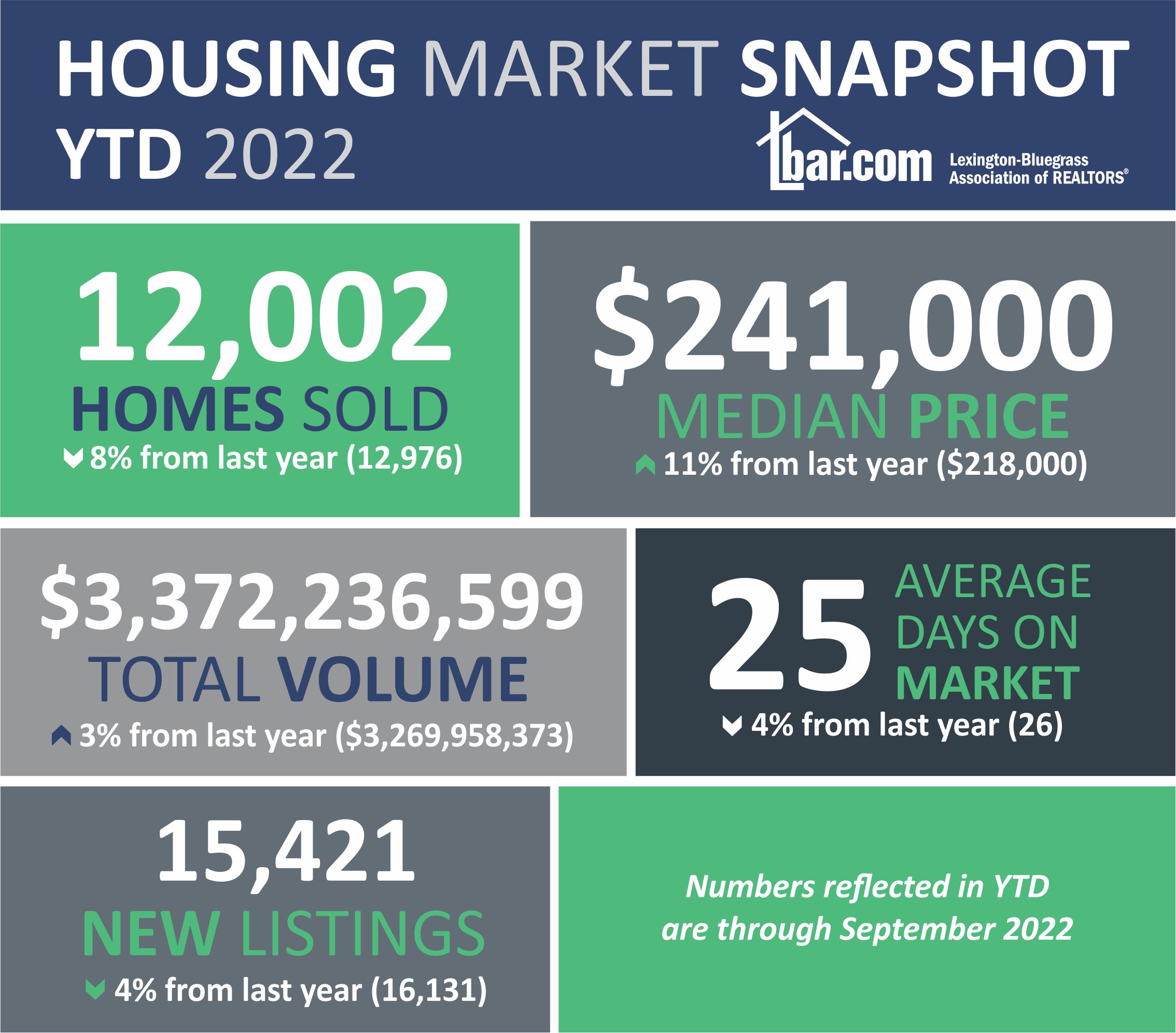

FRANKFORT, Ky. — Housing inventory has risen every month since the first quarter of 2022, with September reporting the highest inventory levels since prior to the pandemic. September saw the number of homes on the market jump to 3,188, a 6% increase over last year’s 3,015.

Months of inventory have remained above the 2-month mark for three consecutive months and have risen since early spring. In September, the months of inventory hit 2.4, a 20% jump from last year when it stood at 2.

Months of inventory have remained above the 2-month mark for three consecutive months and have risen since early spring. In September, the months of inventory hit 2.4, a 20% jump from last year when it stood at 2.

With a jump in inventory and a slowdown in sales, properties remained on the market 20% longer in September, with an average of 25 days compared to last year’s 20 days. Although rising 100% year-over-year, the median DOM from 5 days last year to 10 days in September 2022 still shows homes selling relatively fast.

“Inventory levels are key to our market health here in this region,” said Underwood. “As interest rates rise, more homes offered for sale will help keep prices in check and help meet the demand from buyers. Right now, it appears the inventory jump is likely from the slow-down in sales and not entirely from an increase in new listings.”

Heading into the last quarter of the year, when temperatures start to drop, it’s normal for new listings to start dropping month over month. New real estate listings in Central and Southern Kentucky dropped 14% compared to a year ago, with 1,601 residential properties versus 1,856 in 2021, and down 9% from July. The good news is September’s new listings were the second highest for the month since 2006, behind only last year.

September was the third consecutive month with home sales declining, year-over-year. Sales were down 15% in September from a year ago as sales hit 1,305 in 2022 compared to 1,541 in September 2021.

Single-family home sales declined 16%, with 1,208 sales in September compared to 1,436 sales last year. Townhouses/condos dropped 8%, with 97 sales compared to 105 in 2021. Townhouses/condos made up over 7% of the total market in September.

Interest rates continued their rise through September, jumping to over 6% early and closing in on 7% by the end of the month. This resulted from the Fed raising the interest rate by a .75 percentage point for the third straight time and the fifth rate increase this year.

Pending sales have been affected by the rate hikes, with homes under contract down 16% year over year. September saw 1,254 pending sales, with 1,485 last year.

“As a way to curb inflation, the federal government is raising the interest rate,” stated Underwood “The result of doing this has pushed some potential buyers out of the market and caused some current homeowners, who may have otherwise listed their home, to stay put, so they don’t lose their current rate. On the flip side, reports show first-time homebuyers are making a comeback after sitting out for several years despite higher home prices.”

Median home prices pushed to a new all-time monthly high, reaching $242,000, up 10% over last year when the median was $220,000. September marked the 43rd consecutive month of year-over-year price appreciation. However, the September median price was 3% lower than the previous month as prices tend to soften going into the colder months. Single-family home prices stood at $243,000, while townhouse/condo prices were $230,000.

Median home prices pushed to a new all-time monthly high, reaching $242,000, up 10% over last year when the median was $220,000. September marked the 43rd consecutive month of year-over-year price appreciation. However, the September median price was 3% lower than the previous month as prices tend to soften going into the colder months. Single-family home prices stood at $243,000, while townhouse/condo prices were $230,000.

September’s total volume dropped to just under $370 million in residential real estate sold, a 7% decline over last year’s total of $397 million, still the second-highest September on record behind only 2021’s total.

Click here for more Kentucky business news.