Coronavirus has hit America’s senior population especially hard in terms of health, but the pandemic has also highlighted issues that some people 65-and-older already face with regard to their finances. Balancing medical bills on top of basic expenses for food and shelter – in addition to making sure one has enough retirement savings – can be a challenge. That’s why SmartAsset decided to take a look at where in the U.S. seniors are most and least financially secure.

To find the cities where seniors are most and least financially secure, we examined data for the 100 cities with the largest 65-and-older population across seven metrics: average senior retirement income, percentage of seniors below the poverty line, percentage of seniors receiving Supplemental Nutrition Assistance Program (SNAP) benefits, percentage of seniors who own their homes, percentage of seniors with retirement income, percentage of seniors who are housing cost-burdened and housing costs as a percentage of average senior retirement income. For details on our data sources and how we found our final rankings, check out the Data and Methodology below.

Key Findings

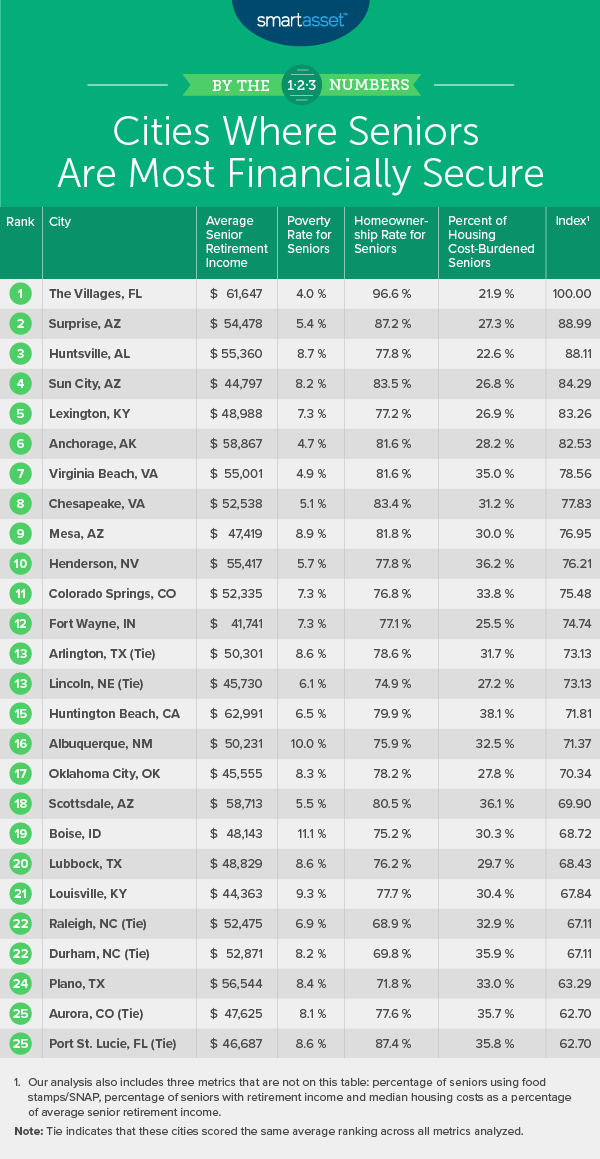

- Southern and Western cities dominate the top 10. The top 10 cities in the study where residents 65 and older are most financially secure are spread equally across only Southern and Western states. Three Arizona cities make it into the top 10 – Surprise, Sun City and Mesa – all ranking within the top 10% of the study for their high percentages of seniors who own their homes. Two Virginia cities rank in the top 10 as well – ranking within the top 5% of the study for both their relatively low percentages of seniors below the poverty line and high percentages of seniors with retirement income.

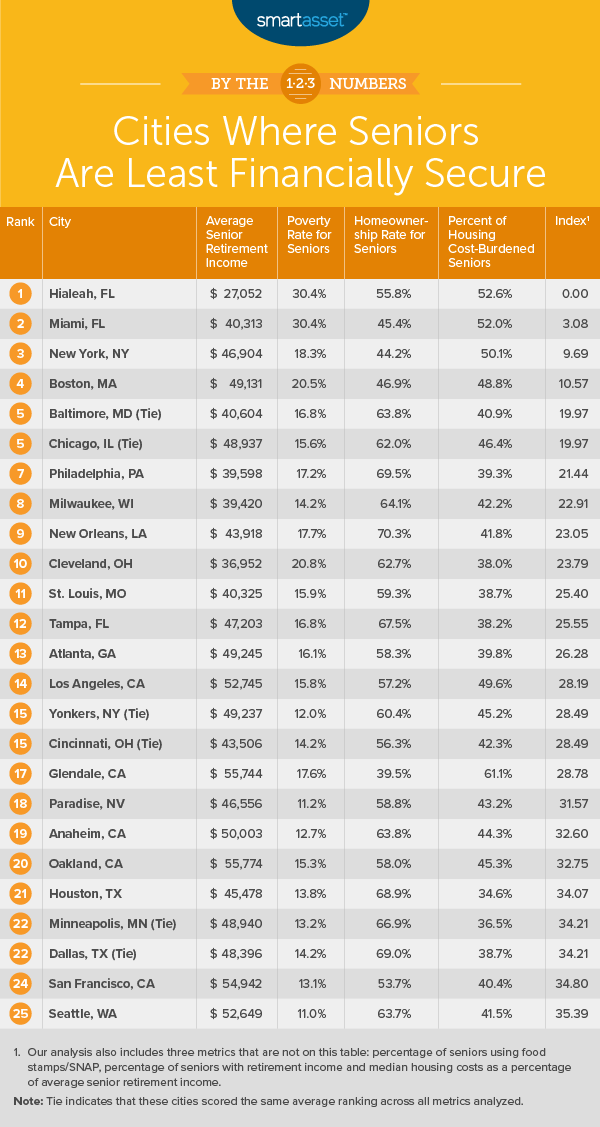

- Large gaps across cities for the percentage of seniors living below the poverty line. Across the top 10 cities in our study, the average percentage of seniors living in poverty is approximately 6%. By contrast, the average percentage of seniors below the poverty line across the bottom 10 cities in our study is more than three times that figure, at about 20%.

- Retirement income is a concern, even in cities where seniors are most financially secure. Even though the top 10 cities where seniors are most financially secure all rank within the top 25% of the study for their percentage of seniors with retirement income, Census Bureau data shows that there are still many local seniors who do not have additional retirement funds saved. An average of more than four in 10 seniors in those cities does not have retirement income from a pension or retirement account such as a 401(k) or IRA.

Add Comment