LEXINGTON, Ky. — Properties listed for sale in Central and Southeastern Kentucky have experienced an increase in showings over the past two months. Appointments to view listings have seen a 10% and 7% uptick in September and October, respectively.

This follows three months of decreases after back-to-back all-time highs for showings in April and May. “This spring was frenetic with buyers scrambling to get in every property that came online,” said Kristy Gooch, president of the Lexington-Bluegrass Association of Realtors (LBAR). “It caused many buyers to pull back from the market because most offers were met with stiff competition and they became worn down by the activity. Although the market is still moving fast, some buyers now have time to view a few properties before putting in an offer.”

This follows three months of decreases after back-to-back all-time highs for showings in April and May. “This spring was frenetic with buyers scrambling to get in every property that came online,” said Kristy Gooch, president of the Lexington-Bluegrass Association of Realtors (LBAR). “It caused many buyers to pull back from the market because most offers were met with stiff competition and they became worn down by the activity. Although the market is still moving fast, some buyers now have time to view a few properties before putting in an offer.”

Days on market for homes in the summer dropped to as low as 17 days. In October, that number increased to 20 days, which is still much lower than last year when it was 33 days, but an improvement for buyers looking in the last few months of the year.

Inventory levels in October matched the 1.6-month supply from the previous month but were up 14% from last year when the market was sitting at 1.4 months. Total housing inventory hit 2,404 residential properties in October, the third straight month of levels being above the 2,000 thresholds. This includes the addition of Somerset-Lake Cumberland region properties; however, even without the inclusion of Somerset, inventory levels would still be on the rise from where the market stood throughout the spring months when levels hit all-time lows, hovering below 1,500 total properties.

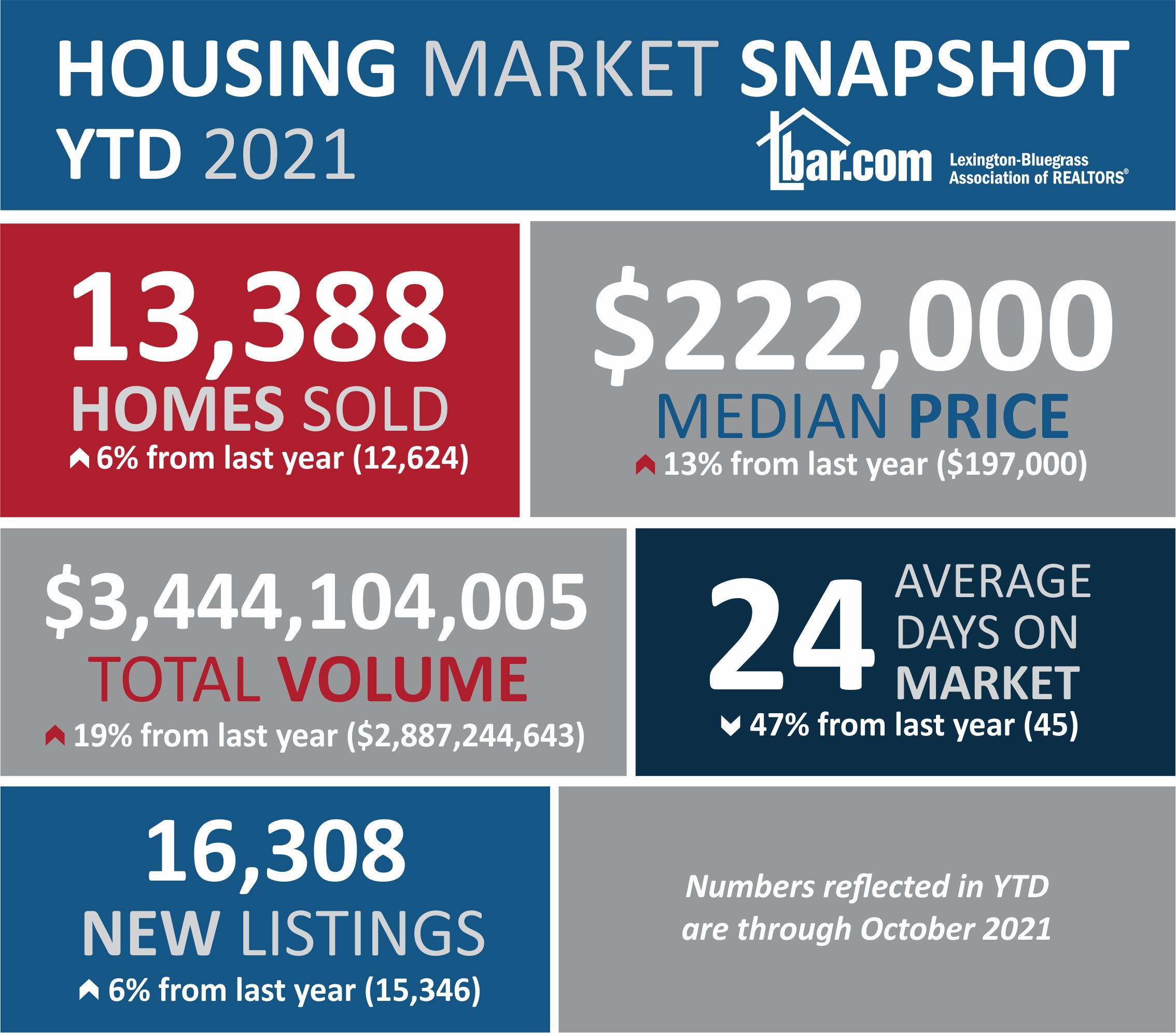

New listings dropped from the previous month by 12% but hit a monthly high for October at 1,574 listings. Again, this number was bolstered by the Somerset region but is up 4% from last year. Without the additional listings included, the number would have been relatively the same from October 2020 which is lower than what is needed to support the buyer demand currently at play in the market. “More listings would alleviate some of the frustrations buyers are facing from a lack of inventory; however, sales remain strong at a time when the market typically starts to cool off,” stated Gooch. “Real estate, through the pandemic, seems, at least for now, to have shifted buyer behavior to stay in the market through the historically slower months. Sales in 2021 are outpacing last year, which was the most active on record for LBAR.”

Total sales for October hit an all-time high with 1,464, a 6% increase over last year when sales were 1,375. In 2021, other than a slight decrease in July, every month so far has seen a year-over-year gain in transactions. Single-family home sales increased 6% while townhouse/condo sales jumped 18% year-over-year.

Townhouses/condos made up less than 7% of the total market in October. Year-to-date, sales are also up 6% with 13,388 transactions closed in the first ten months of the year, compared to 12,624 during the same period last year.

New construction home sales rose 4% for the month, reaching the second-highest total of the year with 118 sales, and up 22% from the previous month. This is the first time in seven months that new construction sales have risen. For the year, new home transactions have dropped 18%. Pending sales have remained strong going into the fourth quarter of the year with 1,539 sales under contract, compared to 1,352 last year.

New construction home sales rose 4% for the month, reaching the second-highest total of the year with 118 sales, and up 22% from the previous month. This is the first time in seven months that new construction sales have risen. For the year, new home transactions have dropped 18%. Pending sales have remained strong going into the fourth quarter of the year with 1,539 sales under contract, compared to 1,352 last year.

October marked the third month in a row with pending sales increases and now sits practically even with last year’s record total through the first ten months of the year. “Predictions coming out of Fannie Mae and other top economists say sales may level off nationally over the next two years,” says Gooch. “But as rents rise and consumer prices continue to go up, prospective buyers may want the security of a fixed and consistent mortgage payment into the future. Especially in a region that, despite recent pricing hikes, still boasts a median home price that is 36% less than the national median.”

And buyers who are on the sidelines may want to consider entering into the market before interest rates climb. Rates have ticked up the past two months and with inflation and the Fed’s recent decision to taper asset purchases, they could continue to go up in 2022. Current rates are still close to 3%, however, reports show the rate could push to 3.5% in 2022 and as high as 4.3% in the second half of 2023.

Gooch stated, “The best thing to do if you are a serious buyer is to first, call a Realtor® to understand the market within the context of your unique situation. The next step should be to contact a lender to get pre-approved. Being nimble and ready to move in this environment is very important.”

Click here for more Kentucky business news.