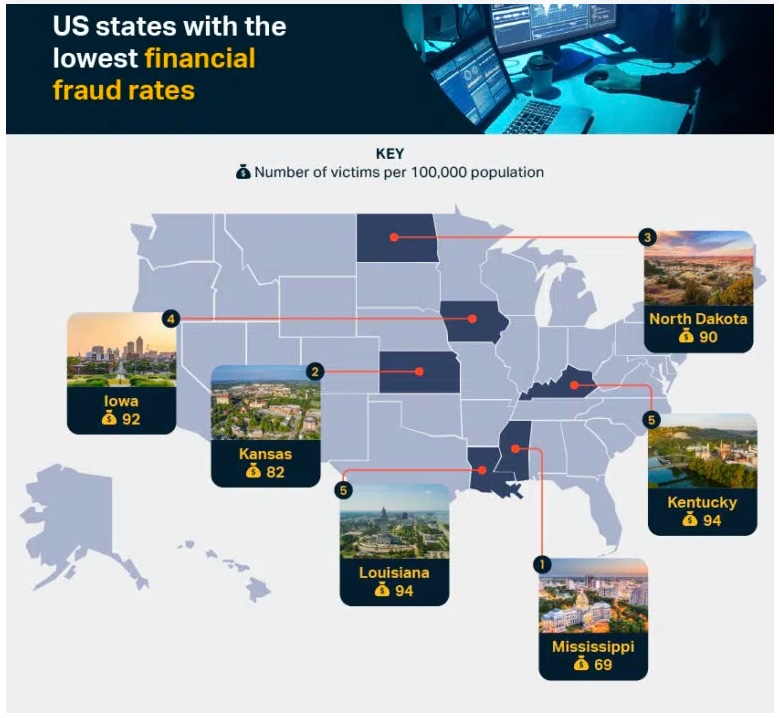

TORONTO, Ontario, Canada — A new study has revealed the states with the lowest rates of financial fraud, with Kentucky taking the fifth best spot. Mississippi ranked best and Nevada worst.

TORONTO, Ontario, Canada — A new study has revealed the states with the lowest rates of financial fraud, with Kentucky taking the fifth best spot. Mississippi ranked best and Nevada worst.|

Rank |

State |

Number of victims per 100,000 population |

|

1 |

.Mississippi |

69 |

|

2 |

.Kansas |

82 |

|

3 |

.North Dakota |

90 |

|

4 |

.Iowa |

92 |

|

5 |

.Kentucky |

94 |

|

6 |

.Louisiana |

94 |

|

7 |

.Arkansas |

95 |

|

8 |

.Alabama |

96 |

|

9 |

.North Carolina |

99 |

|

10 |

.Nebraska |

99 |

-

Nevada has the highest financial fraud rate of 286 per 100,000 population. Despite having the highest financial fraud rates across all 50 states, Nevada’s law makes fraud a criminal offence with penalties of up to one to four years in prison and up to $5,000 in fines,

-

Phishing is the most common type of financial crime, with the number of cases five times higher than data breaches – which take the second spot. It occurs when attackers trick users into revealing sensitive information or installing malware.

-

In a comparison of the top 20 countries with the highest number of victims, the United States tops the list by a landslide, with almost half a million victims in total.

- Nevada has the highest financial fraud rate of 286 per 100,000 population. Despite having the highest financial fraud rates across all 50 states, Nevada’s law makes fraud a criminal offence with penalties of up to one to four years in prison and up to $5,000 in fines,

- Phishing is the most common form, with the number of cases five times higher than data breaches — which take the second spot. It occurs when attackers trick users into revealing sensitive information or installing malware.

- In a comparison of the top 20 countries with the highest number of victims, the United States tops the list by a landslide, with almost half a million victims in total.