LEXINGTON, Ky. and ATHOL, Mass. — The L.S. Starrett Co. announced this week it has entered into a definitive merger agreement in a go-private transaction with an affiliate of Lexington, Ky.-based MiddleGround Capital (“MiddleGround”) in an all-cash transaction for $16.19 per share.

LEXINGTON, Ky. and ATHOL, Mass. — The L.S. Starrett Co. announced this week it has entered into a definitive merger agreement in a go-private transaction with an affiliate of Lexington, Ky.-based MiddleGround Capital (“MiddleGround”) in an all-cash transaction for $16.19 per share.

The purchase price represents an approximately 63% premium to the closing stock price of the Company’s stock on March 8, 2024, the last trading day prior to announcing the transaction. On Wednesday, March 13, Starrett was trading at $15.77 and had a market capitalization of $109.7 million.

MiddleGround Capital is a private equity firm based in Lexington with over $3.5 billion of assets under management. MiddleGround makes control equity investments in middle market B2B industrial and specialty distribution businesses. MiddleGround works with its portfolio companies to create value through a hands-on operational approach and partners with its management teams to support long-term growth strategies.

“We are pleased to reach this agreement with MiddleGround, which provides a meaningful premium cash value to our shareholders,” said Douglas A. Starrett, chairman, CEO and president of Starrett. “Following comprehensive outreach to potential parties, our Board of Directors determined that MiddleGround is the right partner for Starrett because of its deep knowledge within the manufacturing industry. As a private company, the company will have additional financial and operational flexibility to continue providing industry-leading service and products to our customers across our markets and maintaining Starrett’s proud tradition among its employees, communities and other stakeholders.”

“MiddleGround is thrilled to be partnering with Starrett, a brand we have long admired, and a company that we have followed in the public markets for several years. Most of MiddleGround’s Operations team gained familiarity with Starrett products over the course of their manufacturing careers, and we are excited about the opportunity to further position the company for its future on the front lines of innovation, advanced manufacturing and reshoring,” said John Stewart, managing partner of MiddleGround.

Transaction Details

The proposed transaction has been approved by the Starrett Board of Directors. MiddleGround intends to fund the transaction with a combination of cash from MiddleGround Partners III, L.P. and committed financing, which is not subject to any contingency.

The transaction is expected to close in mid-2024, subject to the requisite approval by Starrett’s shareholders and other conditions to closing.

Following completion of the transaction, Starrett will become a wholly owned subsidiary of MiddleGround and Starrett’s Class A common stock will no longer be listed on any public market.

Lincoln International LLC is serving as lead financial advisor to Starrett and Ropes & Gray LLP is serving as legal counsel to Starrett.

William Blair & Co. L.L.C. is serving as exclusive financial advisor to MiddleGround in connection with the acquisition and debt financing of Starrett, and Dechert LLP is serving as legal counsel to MiddleGround.

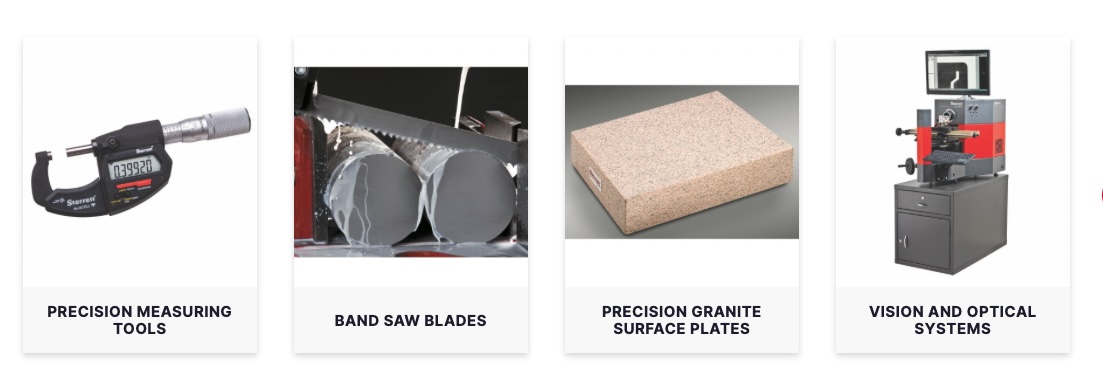

Founded in 1880 by Laroy S. Starrett and incorporated in 1929, The L.S. Starrett Co. manufacters high-end precision tools, cutting equipment, and metrology systems, and is engaged in the business of manufacturing over 5,000 different products for metalworking, wood, food, semi-conductor production, aerospace, medical, oil and gas, machinery, government, equipment, and automotive markets. For more information, please visit: https://www.starrett.com/.

For more information, please visit: https://middleground.com/.