WASHINGTON, D.C. — Despite the legal requirements for most states mandating vehicle coverage, many drivers still hit the road uninsured and without proper protection.

WASHINGTON, D.C. — Despite the legal requirements for most states mandating vehicle coverage, many drivers still hit the road uninsured and without proper protection.

With around 29 million uninsured drivers in the United States, the team at MarketWatch Guides has analyzed the data to uncover just how many drivers still hit the road without proper protection.

Looking at the states with the most and least uninsured drivers, the study delves into the underlying reasons behind people driving without insurance, the implications and the potential consequences of driving uninsured in each state.

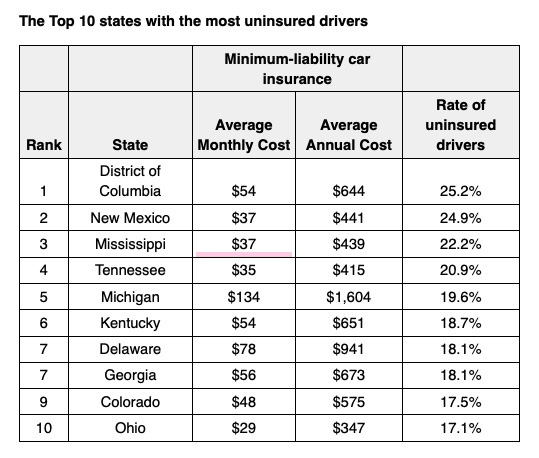

The Top 10 states with the most uninsured drivers

|

Minimum-liability car insurance |

||||

|

Rank |

State |

Average Monthly Cost |

Average Annual Cost |

Rate of uninsured drivers |

|

1 |

District of Columbia |

$54 |

$644 |

25.2% |

|

2 |

New Mexico |

$37 |

$441 |

24.9% |

|

3 |

Mississippi |

$37 |

$439 |

22.2% |

|

4 |

Tennessee |

$35 |

$415 |

20.9% |

|

5 |

Michigan |

$134 |

$1,604 |

19.6% |

|

6 |

Kentucky |

$54 |

$651 |

18.7% |

|

7 |

Delaware |

$78 |

$941 |

18.1% |

|

7 |

Georgia |

$56 |

$673 |

18.1% |

|

9 |

Colorado |

$48 |

$575 |

17.5% |

|

10 |

Ohio |

$29 |

$347 |

17.1% |

District of Columbia (D.C.) has the most uninsured drivers compared to any other state, with more than a quarter of road users (25.2%) going uninsured. The annual average cost of D.C. minimum-liability car insurance is $644, significantly higher than most other states, especially Vermont ($282). This cost is perhaps due to the state’s higher population density and heavier traffic.

With almost a quarter of uninsured drivers, New Mexico is the second state with the highest number of road users without car insurance. Like Mississippi and Oklahoma, the average monthly cost for minimum-liability car insurance in New Mexico is $37, while its annual cost is an average of $441.

In third place is Mississippi, with 22.2% of people driving without insurance. The Southern state is relatively affordable regarding car insurance, with the average monthly cost of $37 for minimum-liability car insurance, equating to approximately $439 annually. However, despite its cheaper insurance premiums, Mississippi has one of the lowest household incomes in the US, which is perhaps why many drivers choose to go uninsured.

Further findings:

-

Wyoming has fewer uninsured drivers than any other state, with a rate of 5.9% of vehicle users having no insurance. The landlocked state has the third most affordable average monthly car insurance ($26).

-

Delaware has the most expensive fines for uninsured drivers, topping the list with a fine of $1,500 for first offenses. Although the state doesn’t require jail time like some states, it has one of the longest license suspensions – six months for first-time offenders.

-

Missouri has the most lenient fines for uninsured drivers, with first offenders fined just $20 and a license suspension until they provide proof of insurance. The state also requires no jail time.