LOUISVILLE, Ky. — Louisville Water Company has secured funding to continue improvements in its water system. On Thursday, Oct. 17, Louisville Water sold $155.54 million in bonds, of which $88 million will fund capital projects over the next several years. Additionally, $75.31 million went towards refinancing the company’s series 2009 bonds. The refunding saves ratepayers $8.56 million over the next 10 years. The borrowing rate was approximately 2.27%.

The bond issuance follows Standard & Poor’s (S&P) and Moody’s Investors Service reaffirming their highest marks for Louisville Water. S&P affirmed a AAA rating, its highest mark and Moody’s Investors Service affirmed its highest rating, Aaa. Both agencies cited Louisville Water’s proactive and robust capital planning, strong financial position and a broad, diverse and growing service area.

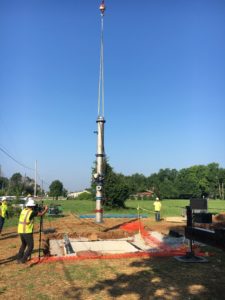

The bond issuance will fund Louisville Water’s capital program with a focus on inspecting, repairing and replacing water mains, investments in water treatment facilities and installing new technology.

“Our strong financial position allowed us to gain funding for our capital program while at the same time saving our ratepayers millions of dollars,” said Lynn Pearson, Louisville Water’s vice president of Finance and Treasurer. “A company-wide focus on strong fiscal management allows us to maintain favorable rates for our customers and provide best-in-class service.”

Raymond James served as Louisville Water’s financial advisor for the sale. This is the first new money issuance since 2015. Louisville Water provides drinking water to nearly one million people in Louisville Metro and surrounding counties. The company operates two treatment facilities; both ranked as two of the top 18 in North America and maintains nearly 4,200 miles of water main.

Add Comment