FRANKFORT, Ky. — Recent data on Kentucky’s economy shows mixed signals, with signs of both economic cooling and continued growth. This data comes as significant national challenges unfold, including a major labor strike in the manufacturing sector and a looming shutdown of the federal government. Kentucky is more well-positioned to confront a possible economic slowdown than in the past, but business leaders and policymakers should continue monitoring economic data closely.

FRANKFORT, Ky. — Recent data on Kentucky’s economy shows mixed signals, with signs of both economic cooling and continued growth. This data comes as significant national challenges unfold, including a major labor strike in the manufacturing sector and a looming shutdown of the federal government. Kentucky is more well-positioned to confront a possible economic slowdown than in the past, but business leaders and policymakers should continue monitoring economic data closely.

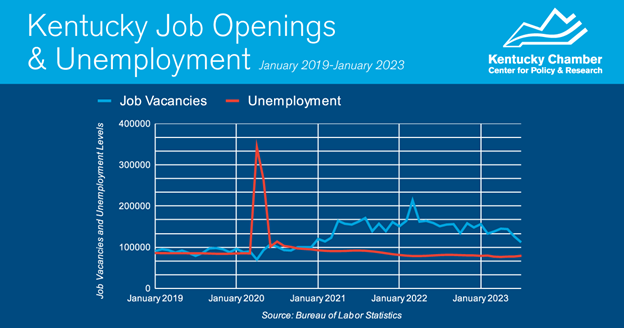

Data released this week by the Bureau of Labor Statistics (BLS) showed a rise in unemployment and a decline in job openings in the commonwealth. Job openings ticked down to 112,000 in July 2023, the lowest level reported for Kentucky since December 2020. Throughout the economic recovery, job openings have run high, peaking at more than 200,000 in March 2022. Most months during this period showed an average of about 150,000 job openings.

Since 2021, the high number of job openings in Kentucky has outpaced the number of unemployed Kentuckians looking for a job. Throughout 2022, Kentucky averaged two open jobs for every unemployed worker. This ratio has declined through 2023. As of July 2023, there were 1.4 open jobs for every unemployed worker. The job market remains tight for employers, especially compared to 2019 when the state tended to average 1 open job per unemployed worker. The ratio of job openings to unemployed workers may simply be “normalizing” following a historically tight labor market in 2021 and 2022.

A similar trend may be unfolding with unemployment. In February 2022, Kentucky set an all-time low unemployment rate at just 3.9%. The rate fell to 3.7% in April 2023. As of August 2023, preliminary data showed a rate of 4.0%. Despite a slight upward trend, unemployment in Kentucky remains low. In August 2019, it was 4.1% (it was 4.0% in August 2022).

Two other important metrics are the workforce participation rate and the employment rate. Workforce participation in Kentucky remains stubbornly below pre-pandemic levels at just 57.6%, 1.4 percentage points below where it stood in August 2019. Kentucky’s workforce participation rate is among the bottom 10 lowest in the nation. The employment rate in August was 55.3%. Like workforce participation, this was lower than August 2019’s rate of 56.6%.

Economic data such as job openings, unemployment, and workforce participation come from monthly government surveys of employers and households. The most recent data is preliminary and subject to revisions.

The drop in job openings and rise in unemployment in Kentucky are both likely attributable to rising interest rates. To combat inflation, the Federal Reserve Bank has gradually raised interest rates. Such actions tend to reduce economic activity and business investment, which has the twin effects of reducing inflation levels and increasing unemployment. Federal Reserve Chairman Jerome Powell has stated that the Fed’s intent with increasing interest rates is to achieve a “soft landing,” in which inflation cools while the economy continues growing and adding jobs.

Other economic metrics paint a somewhat different picture of Kentucky’s economy than what we see with job openings and unemployment. Kentucky employers, for instance, have continued to add new payroll positions (jobs). In March 2023, the state surpassed 2 million nonfarm payroll positions for the first time in its history. Kentucky employers have continued to build on this momentum, even adding 8,300 new jobs in August. Information on nonfarm payrolls derives from surveys of employers and is different from information on “employment,” which comes from surveys of households. Some nonfarm payroll positions may be held by the same individual (multiple job-holders) or by out-of-state workers.

State revenue data also shows signs of continued economic growth. Last month, state receipts — from sources like sales taxes, business taxes, and property taxes — rose 7.7% year-over-year. Sales tax revenues — often an indicator of retail activity and consumer spending — rose 5% year-over-year.

These mixed signals regarding Kentucky’s economy come as two major national challenges unfold. The first is the labor strike initiated by the United Auto Workers against Ford, General Motors and Stellantis. The second is an anticipated shutdown of the federal government caused by the inability of Congress to pass legislation necessary to continue funding government operations. As noted by the U.S. Chamber of Commerce, both of these events will have negative impacts on the national economy, which would include Kentucky as well. In addition to these challenges, the effects of rising interest rates and the war between Ukraine and Russia in Eastern Europe will continue to reverberate across the global, national, and state economies.

As Kentucky leaders navigate this era of uncertainty, the state is more well-positioned than in the past to weather economic challenges. Kentucky boasts a healthy Budget Reserve Trust Fund of $3.7 billion and an Unemployment Insurance Trust Fund of close to $850 million. In addition, the state is more economically competitive than in the past thanks to major policy changes such as tax reform.

Nonetheless, business leaders and policymakers should closely monitor state and national economic data as these events continue to unfold and as new information comes in. The Kentucky Chamber Center for Policy and Research will provide additional updates via The Bottom Line.

—By Charles Aull, Kentucky Chamber of Commerce