As bank representatives across the commonwealth will attest, financial institutions don’t merely focus on numbers and bottom lines—they also give back in numerous ways to better the lives of their neighbors, customers and others in the communities they serve.

As bank representatives across the commonwealth will attest, financial institutions don’t merely focus on numbers and bottom lines—they also give back in numerous ways to better the lives of their neighbors, customers and others in the communities they serve.

This “giving back” is genuine, but it also has a business benefit. It creates a visibility and thus a branding. It creates a two-way flow of information by word of mouth and by observation about bank services and products as well as what clients and potential clients are doing and planning. That, in turn, creates opportunities to enhance or open lines of business. It builds insight and trust.

And of course, a thriving community is one that grows its economy—and bank business.

Cathy Taylor says her employer, Community Trust Bank Inc., doesn’t have a flashy marketing campaign about all the ways associates donate their time and money toward different charitable causes, but still, the impact of their good works is clear.

“Our folks put in endless hours to serve on boards, to work in the community and to make change, and that’s a great story that we have to tell,” said Taylor, who serves as vice president, Lexington market and central region security representative with CTBI, where she’s worked for 25 years.

CTBI has 79 locations reaching to Northern Kentucky, Louisville, Knoxville, Tenn., and western West Virginia. Taylor said bank employees support organizations like Bluegrass Crime Stoppers, which helps solve crimes; Habitat for Humanity, which works to increase opportunities for affordable housing; and other organizations impacting youth, including working with area school systems and groups like Junior Achievement, Court Appointed Special Advocates (CASA) and Shriners Hospital. The Pikeville-headquartered bank has also donated funds toward the development of Town Branch Park in downtown Lexington, one of many organizations and individuals helping to make that dream a reality.

“Some of our contributions may not come in the form of money; some of our contributions may come in the form of spending time,” Taylor said.

Bank of Lexington President Cindy C. Burton is a board member with the Lexington Humane Society, a cause especially dear to her heart as she owns a beloved shelter dog.

“We are a preferred partner with LHS,” she said. “We sponsor many of their events, but one of our most unique contributions comes in the form of a $100 donation in the name of every customer who closes on their primary residence with Bank of Lexington. We have also done dog/cat food drives for LHS.”

Burton said her philosophy has always been if the bank, which has three locations, is going to give money, its associates are also going to give their time.

“I think it is important to support groups my employees have ties to, whether it’s their child’s ball team or if they sit on a board of a local nonprofit,” she said. “If it is important to them, it is important to me.”

Some of the groups with which the bank and its associates are involved include Sweat 4 Surgeries benefiting Surgery on Sunday, Boy Scouts and Girl Scouts troops, Little League sports teams, UK Leads Scholarship, Swing for Soldiers, Oktoberfest, Catholic Action Center, Psalm 8:23 Mission and numerous golf outings for various charities.

Around Christmas, Bank of Lexington becomes a drop-off location for Operation Secret Santa, and employees and customers donate toys, too.

At the other end of the size spectrum is Cincinnati-headquartered Fifth Third Bank, which has 69 Kentucky locations and over 1,000 others outside the commonwealth. Vice President, Community Impact Manager Adam Hall outlined some of the ways his bank encourages team members to be involved and engaged in their communities.

“We have team members who volunteer with causes as wide ranging as coaching youth sports leagues, out-of-school-time tutoring programs, the Humane Society, Habitat for Humanity and many other activities,” he said, adding that full-time employees can take up to eight hours paid time off annually to volunteer for these and other organizations.

As a financial institution,

Fifth Third also strives to make an impact through supporting United Way’s annual giving campaign, and rallies bank volunteers for the organization’s Day of Action.

Fifth Third Day, held each May 3, is a chance for the bank to help alleviate food insecurity in communities served.

“During the month, we support nonprofit food pantries and meal centers with cash donations, food drives, and in-person volunteer support,” Hall said. “In 2023, we provided over 10 million meals across our footprint.”

Being a supporter of the arts is another way to positively benefit the community, and Hall said Fifth Third Bank pools corporate grants along with employee pledges benefiting Fund for the Arts in Louisville and LexArts in Lexington.

In 2021, Fifth Third launched its Empowering Black Futures Neighborhood program, which Hall said focuses on nine neighborhoods in the bank’s footprint that are majority African American and have historically suffered from racist policies like redlining and urban renewal.

“The bank is investing $20 million in each neighborhood to improve upward mobility among Black residents, promote prosperous small Black-owned businesses, develop healthy built environments, create more equitable, connected systems, and build an inclusive civic infrastructure,” he said.

The Russell neighborhood in Louisville, located west of downtown, was selected as a program target area for Kentucky, Hall said. In response, Fifth Third has dedicated investments and volunteer hours toward affordable housing, homeownership preservation and aging– in–place initiatives, small-business technical assistance and neighborhood improvements there.

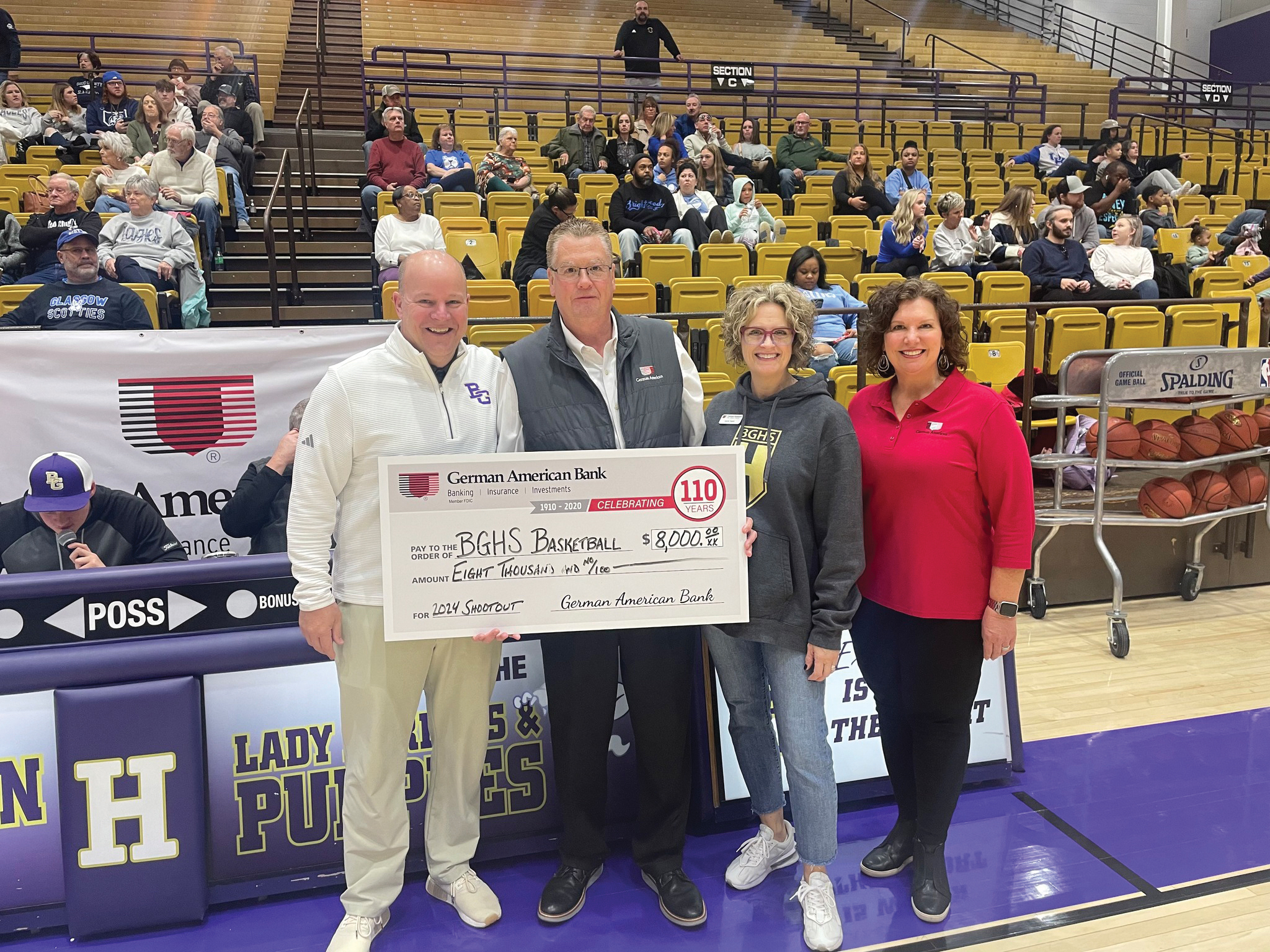

German American Bank Senior Regional President Adrian Brown said his Jasper, Ind.-based bank operates a successful School Spirit Check Card program, in which customers can choose a favorite area school’s logo for their check card and for each purchase, the bank donates 2 cents toward their school of choice.

The funds really add up, Brown said, as nearly $100,000 in donations have been made to schools thus far.

German American has 28 Kentucky locations and 47 more in the rest of its footprint.

Brown said it’s embedded in the bank’s culture to give back to communities served, and employee interests and passions often help determine where funds are donated.

“It’s really hard to make these decisions sometimes,” he said. “Our bank and our employees are extremely generous, but a community’s needs can outweigh any one organization’s resources.”

“At City National Bank, our commitment to our customers goes well beyond serving their financial needs,” said First Vice President/Region Retail Manager Michelle Buerger. “We serve our communities through charitable contributions, volunteerism, financial education efforts and developing special products that meet the needs of those in our communities.”

These include supporting hundreds of charities annually, she said, including social service agencies, community and economic development groups, cultural and arts organizations, and others, with many employees serving as trustees, directors and advisors on boards for local organizations.

One particular passion for the Charleston, W. Va.-based bank, which has 24 Kentucky locations and 75 outside the state, is promoting financial education for all ages.

“Our employees spend time in schools, community organizations and senior centers, leading financial education programs like Teach Children to Save, Get Smart About Credit and Safe Banking for Seniors,” Buerger said.

Providing opportunities for those who may struggle financially is another way the bank helps the community. CNB offers Bounce Back Checking to those who’ve been denied the opportunity to open a checking account “and are looking for a fresh start,” she said.

And the City Start Mortgage program at City National Bank offers first-time buyers with low to moderate income buy homes with little to no money down, low flat-rate closing costs and a flexible credit score requirement.

And the City Start Mortgage program at City National Bank offers first-time buyers with low to moderate income buy homes with little to no money down, low flat-rate closing costs and a flexible credit score requirement.

“We also offer special accounts for seniors and community heroes like veterans, first responders, teachers and medical professionals,” Buerger said.

Pittsburg-based PNC Bank has Kentucky’s largest deposit market share with $10.8 billion at its 67 commonwealth locations, according to a 2023 report from the FDIC. One of the nation’s top 10 banks, PNC has another 2,374 locations outside the state.

John Gohmann, PNC regional president for Lexington, said PNC “collaborates closely with community-based nonprofit organizations, with a pronounced emphasis on early childhood education and economic development.”

This is done via grant funding from PNC Foundation, charitable sponsorships from PNC Bank and employee volunteerism, he said, adding that a number of associates are involved with community and charitable organizations’ boards and committees.

The bank even allows employees to take paid time off doing good works, up to 40 hours annually to volunteer with approved organizations.

For the past 20 years, the $500 million, multiyear bilingual initiative PNC Grow Up Great has focused on early childhood education and plans to celebrate this year’s milestone anniversary are underway, Gohmann said.

“Helping prepare young children for success in school and life accomplishes several objectives that create economic impact, both now and in the future,” Gohmann said.

Just as the number of organizations served are diverse, the reasons for supporting them are as different as the individuals involved, bank representatives say.

“PNC’s commitment to strengthen the communities and neighborhoods in which we operate is core to our business model,” Gohmann said. “Our communities are so much more than places where we do business. Our communities are where our employees and customers live and raise their families. When our communities succeed, PNC succeeds.”

He adds that philanthropic/community relations activities are tailored to each market, with senior leaders empowered to make grant funding and sponsorship decisions for maximum impact.

PNC’s client and community relationship directors focus on local sponsorship activities, business development, philanthropic initiatives and community engagement activities and community development bankers strive to positively impact low- and moderate-income neighborhoods with affordable housing, community development lending, economic development and financial education, Gohmann said.

Burton said upon becoming president of the Bank of Lexington three years ago, she made community involvement a priority. Most recently, she joined the board for the Realtor Community Housing Foundation and will be participating in fundraisers to provide wheelchair ramps for people in need statewide.

“These are causes you don’t really think about or understand until you get involved,” she said. “This kind of work is about changing lives, which is so important and fulfilling.”

Sometimes the means by which help is offered must change to ensure those who need it most are best able to receive it. Fifth Third’s Hall said before COVID, the bank worked with a variety of organizations to provide in-person financial empowerment workshops, but as the world changed during the pandemic, so did their programs. The outcomes, he reports, have been positive.

“During COVID, we pivoted to virtual sessions,” he said. “While we are able to convene in-person again, many organizations prefer the virtual format because it removes barriers like transportation and child care for a client to participate in a session.”

Hall said other programs are being refreshed and relaunched, including Finance Academy, which launched in 2017 as a digital education platform for high schoolers to address topics like savings, budgeting and bank account types, and the Fifth Third financial empowerment mobile, a 40-foot bus with computers onboard to bring banking services directly to underserved areas.

Recently, the bus was rewrapped and rebranded and its interior remodeled with new technologies so bankers can help visitors access information even more efficiently, Hall said.

Recently, the bus was rewrapped and rebranded and its interior remodeled with new technologies so bankers can help visitors access information even more efficiently, Hall said.

Community Trust Bank Inc.’s Taylor expressed pride in the myriad ways her colleagues so generously step up to fill community needs for the betterment of so many.

“We work here but we also raise our families and live here, and it takes all of us to make a strong community,” she said.